Many traders think that Forex masters made their fortunes overnight. Well, that only happens in movies and cinemas. If you are living in the Disneyland which has been made for entertainment and taking the kids to their fantasy, you know what we are telling about. Building up Disney land takes time and it was not built overnight. It is our human nature to envy what is good. If we can do one thing right then this is to envy the supreme power because we cannot be like them. Forex masters are making a million dollar, but that is today, they have been on the market for many years. Some of these legends have already passed several decided in the market. You are taking their success for granted. You do not know how much they have spent their time only to learn this Forex market.

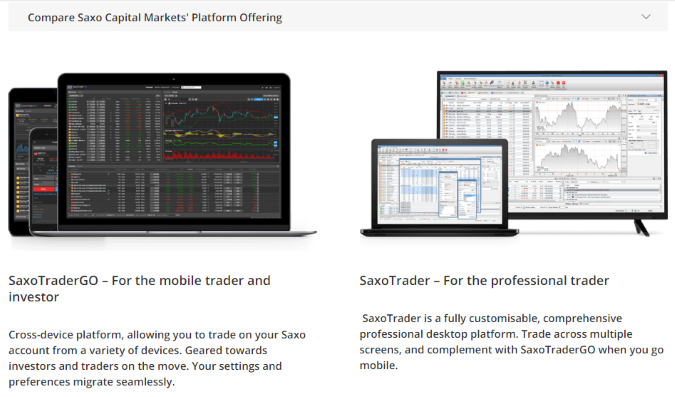

Before thinking God has given them an extra advantage, know theirs story behind their success. If you look at the professional Aussie traders then you will notice that every single one of them has mastered the art of trading of trading with an extreme level of patience before they really executed high-quality trades in their trading platform. However, if you truly want to become a successful trader then make sure that you trade with the reputed broker like Saxo since they offer excellent trading conditions and robust trading platform like SaxoTraderGo. To be a precise trade with a reputed broker if you consider trading as your full-time profession.

Masters were also student once

Every teacher that teaches us in our life and in education, were also students like us as we are now. They did not learn all the things from their mother’s womb. They were sent to school and they also had teachers like us. All these knowledge that they are giving you today, it is because of their teacher’s and their works. In every sphere of life, you cannot achieve success if you do not practice. So if think that you will master the art of trading and execute high-quality trades in your trading platform from the very first day then you are completely wrong. Even the most successful trader in the Australian trading community have spent many months in mastering the art of trading. So make sure that you have a very clear understanding of the market basics before you expect any profit from this market.

Practical experience in trading

Forex masters who are being addressed as legends now today were also the beginner of Forex. They did not know anything and at that time, they could not gain access to different meanings of Forex terms as we do today. Online resources were not available like today. They have learned all of their trading from their work and practice. They are making millions of dollars, because they have spent thousands of hours in the market, trying to figure out the market condition, trying to analyzing the market price level. You only know their success, but you do not want to know their past and follow it to become like them after 10 years. To be honest those who are trading the financial instrument successful nowadays is only because of their sincerity and passion in the financial market.

If you read from their websites, you will see that in the beginning, they had less knowledge than you. They did not know what was what and still they were trying to figure out the market. They were the most patient student of the forex market.

Conclusion: Always try to follow these masters in your life and in your Forex trading. You will get better direction from any others to learn from their lives. When you execute any trades in the market make sure that you follow proper risk management factors in every single trade since it saves your trading capital in the long run.