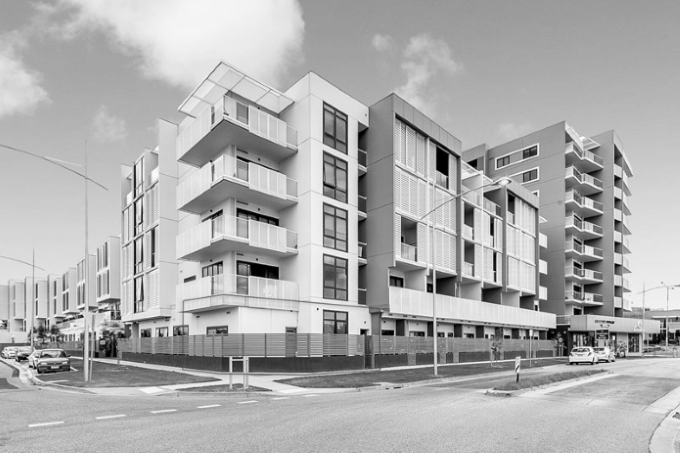

A single house on one block was the normal land use as Melbourne developed and spread after the first world war. It was cheaper to buy land in the new suburbs than the inner city so outer suburbs were created. Fast forward to 2017 and we see uses of existing land being altered by amalgamation into large apartment block sites near transport hubs. Most of the apartments are being sold to property investors as they are comparably cheap in terms of rental return.

Sales are often driven by perceived income, as people believe that "the smaller the property purchase price, the greater the percentage rental."

The draw back ( and it is a big one ) is that the capital gain on the smaller apartments in large multi storey close to the city developments will be small.

The units are cheap to buy but if just one or two owners sell out at a cheap fire sale price in consequence of financial stress, valuers and the World in general will find out the details and that fire sale price will be next base value for the rest of the building.

We asked Jeff Grochowski, principal, at Accrue Real Estate to share his knowledge of the Melbourne property industry.

"Smaller apartments are cheap, so in rental return terms buyers can get say 5% return on a $350,000.00 studio whereas on a $500,000 property the return might be 4%. On paper, the small unit looks good but it comes at a high opportunity cost in terms of capital gain."

"Owners of these apartments soon learn that their capital growth is down due to a limited buyer pool. They can sell to other investors, overseas migrants or the occasional single retiree but they are not on the radar of most property buyers in Melbourne."

"First property buyers should look to entering the market as a town house owner in a well located property that they can potentially sell to families, couples, retirees and first home buyers. The aim is to build a portfolio of unique properties. Later, they can move on to a house. No two houses are ever identical. That is what creates demand. The rarity factor is the key. Unique aspects in terms of design and or location are what drives up the price."

"The rarer the property, the greater the demand and the greater the price"

After speaking with Jeff, the take away for investing in property is that there is not often a unique factor in a small apartment in a block of fifty others on a site near a railway line or a major road. On top of that, there might be twenty similar apartment blocks nearby all competing in a small buyer pool.

Rental returns might be attractive but in the long term, the vision of wealth creation through owning a low cost apartment may just be the metaphorical mirage. Why not find out more by attending a briefing on property matters at a property seminar auckland.