Microsoft is a leading multinational technology company. A look at the prospects for investors looking to trade Microsoft stock.

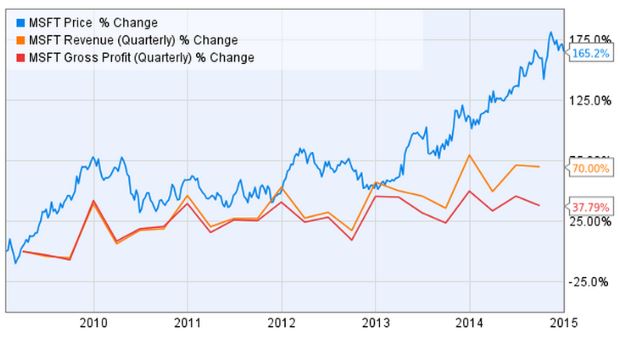

In spite of a dip in fortunes of its traditional flagship Windows business, the transformation of Microsoft (MSFT) into a cloud computing giant seems to be well on course for success. This is due to particularly strong demand for cloud services by the world’s businesses, while there is also some hope of a revival of the Windows platform. In the midst of strong earnings reports and solid projections from its new CEO, MSFT stock has risen to its highest levels in 10 years, making it a popular option on the Banc De Binary platform. The question for many investors is: at these record highs, is investment in Microsoft still worth one’s time and money?

Better Past Performance but Still a Reliable Investment

For many analysts and investors, Microsoft is not considered to be the type of attractive investment it appeared to be a couple of years ago, when its stock was cheaper.

However, there is still plenty to admire about Microsoft’s current business performance and its future projections. Although the Windows platform faces significant challenges due to competition from rival operating systems, the strength and continued growth of the company’s cloud computing services are a source of optimism. However, this should be looked at as a long term investment since the company’s cloud business’ revenues of $6.3 billion is only about 8% of Microsoft’s annual total.

For investors who are seeking to put their money in a mega cap stock as part of their portfolio, there are few better options than Microsoft. This is because, according to all indications, the company is likely to generate profits for several years still, and the cloud business’ record growth rate means that it could be a major driver of Microsoft shares in the future as well. However, it is impossible to deny that if there is a slowdown in the cloud computing arm of the business, or if Windows continues to cede ground on rival computing platforms, there could be a drop in the share price.

A Modestly Valued Stock

Microsoft sits in a unique middle ground, where its stock is neither particularly cheap nor overly expensive. Microsoft is currently trading at $52.84 a share. Its trailing P/E ratio over 12 months sits at around 20; this is roughly at par with the S&P index (SPX) average. Although it is higher priced than some mega cap tech stocks including Oracle and Apple, it is cheaper than Google.

Another aspect that has made Microsoft attractive to investors is its dividend yield, which stands at about 2.5%. Because many of the largest tech companies – Microsoft included – are currently sitting on a large stockpile of cash, the company is likely to continue paying such dividends for several years to come. About $94 million, which represents a quarter of the company’s market cap, is held in cash.

The Ongoing Transformation of Microsoft

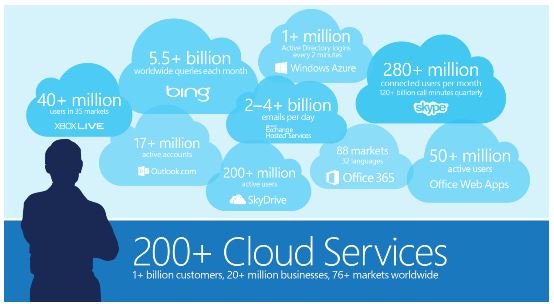

The most impressive aspect of Microsoft’s current operation is the incredible success of its cloud services. In the last quarter alone, MSFT’s commercial revenues from its cloud services have seen a 106% rise annually; this follows a rise of 114% in the quarter prior. The company has attributed the runaway success of the cloud computing business to the continued growth of Dynamics CRM, Azure and Office 365. Although the average consumer has little use for Dynamics CRM (Salesforce software platform) or Azure (a cloud computing service), many users still need - and buy – products from the Microsoft Office suite. In fact, during the last quarter, Microsoft reported that the company now has more than 12 million subscribers to Office 365, which represents a 35% rise on a sequential basis. This has been a great boost to its bottom line, given that sales of many of the company’s legacy products, particularly Windows, have slowed down significantly in recent years. In particular, Windows revenues dropped by 22% during the last quarter, following a contraction of 13% in the prior quarter.

Given the current trend, Microsoft could find it difficult, or even impossible, to directly revive its flagging Windows businesses. The major reason for this is the competition that the software platform faces from Chrome OS, OS X, Android and iOS. These operating systems are increasingly becoming more attractive to the consumer because they are offered to them free of charge, either as direct downloads or preinstalled on original equipment.

In its bid to retain the relevance of Windows in this environment, Microsoft has been forced to offer Windows at a significantly discounted price. In addition, starting with Windows 10, some Windows versions will be offered as free downloads. To boost its Windows revenues, Microsoft is also looking at ways that it can monetize the complementary services that are reliant on the operating system, including Xbox Live and Bing. However, this business model is a foray into the unknown for Microsoft, which means that its success is not guaranteed.

Potential of Cloud Computing and Mobile

Many potential Microsoft investors remain undeterred by the underwhelming earnings report that Microsoft released in January 2015 because they believe in the opportunity presented by the cloud business. This confidence can be put down to two main factors: the currently largely unexploited cloud computing space as well as a belief in the leadership of new Microsoft CEO Satya Nadella. This is because, since his appointment, Nadella has indicated that growing the cloud business is his key objective.

The cloud computing sector is widely expected to expand by about 30% every year through 2020. As a result, the company is in a good position to benefit. In addition, the company’s figures have indicated revenue growth more than doubling in this sector within the first quarter of the year, and Microsoft gaining significant ground on the industry leader in cloud computing, Amazon (AMZN). This kind of growth is made even more impressive by the fact that most of Wall Street had written off Microsoft’s cloud offering only a few quarters ago.

Another thing that investors are impressed by is MSFT’s strategy in the mobile computing space. Microsoft’s strategy team quickly realized that it would make more sense to leverage the platforms developed by its rivals instead of ignoring them. Toward this end, the company made its popular voice assistant software, Cortana, and Microsoft Office compatible with devices running Android as well as the iPhone. In addition, many analysts consider the decision by Microsoft to offer Windows 10 as a free upgrade to existing Windows users to be one that will prove to be a successful one in the long run.

The Bottom Line Regarding Microsoft Stock

There are many different reasons why investors find Microsoft stock such an attractive prospect. First off, it is relatively cheap compared to other mega cap stocks. Another reason is that it yields at least 3% in dividends, and this figure could rise. Third, the yields are likely to be maintained because of the company’s significant cash reserves. However, most importantly, Microsoft’s new CEO and CFO have been an important part of the company’s turnaround in fortunes, and one of the major reasons for optimism over its future. What is important for investors to keep in mind when thinking of purchasing stock and options on Microsoft is that it is a long-term play. This is because Microsoft stock is expected to hit highs of $50 by mid-2016, and can be reasonably expected to have reached $60 by the end of next year.

The fact that many Wall Street traders have expressed reservations about purchasing stock in Microsoft has contributed toward keeping the price of this stock at an artificially low level. However, once the strategies that the company has put in place begin to pay off in the course of next year, many investors will rush to buy the stock, giving an advantage to the traders who identified the opportunity earlier and bought at a lower price.

| < Prev | Next > |

|---|